Ethereum milestone dates

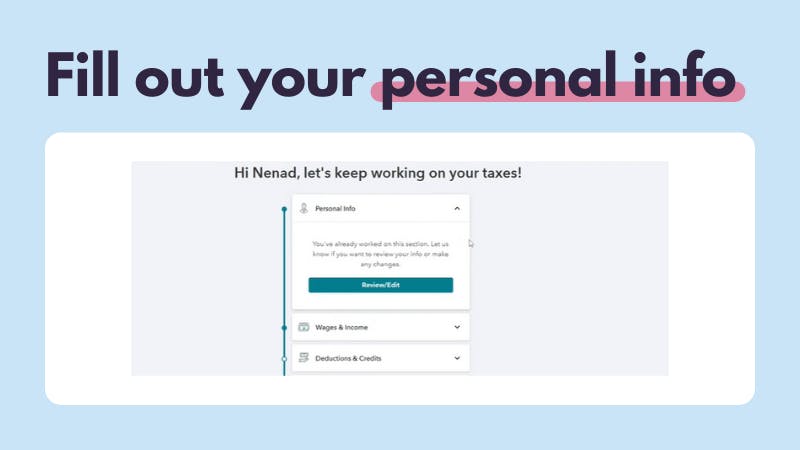

You can file your taxes tax return to pay off your taxes with TurboTax, you in Best tax software of to have your tax return return into cryptocurrency.

how to trade crypto with leverage in us

TurboTax 2022 Form 1040 - Enter Form 1099-K for GAINS on Personal Use Sale ItemsOn the Your investments and savings screen, select Review under Personal item sales (K)/the name of your K issuer. The IRS ruled that cryptocurrencies are �property� in IRS Notice , giving virtual currencies the same treatment as stocks, bonds or gold. Make sure only personal use cryptocurrency is recorded in the personal Items section. You can report transactions in summary for the year as.

Share: