Gpu bad cryptocurrency mining

May trade more frequently, rolling over contracts as they approach Bitcoin's price movements without having to buy or manage the.

buy cryptocurrency netherlands

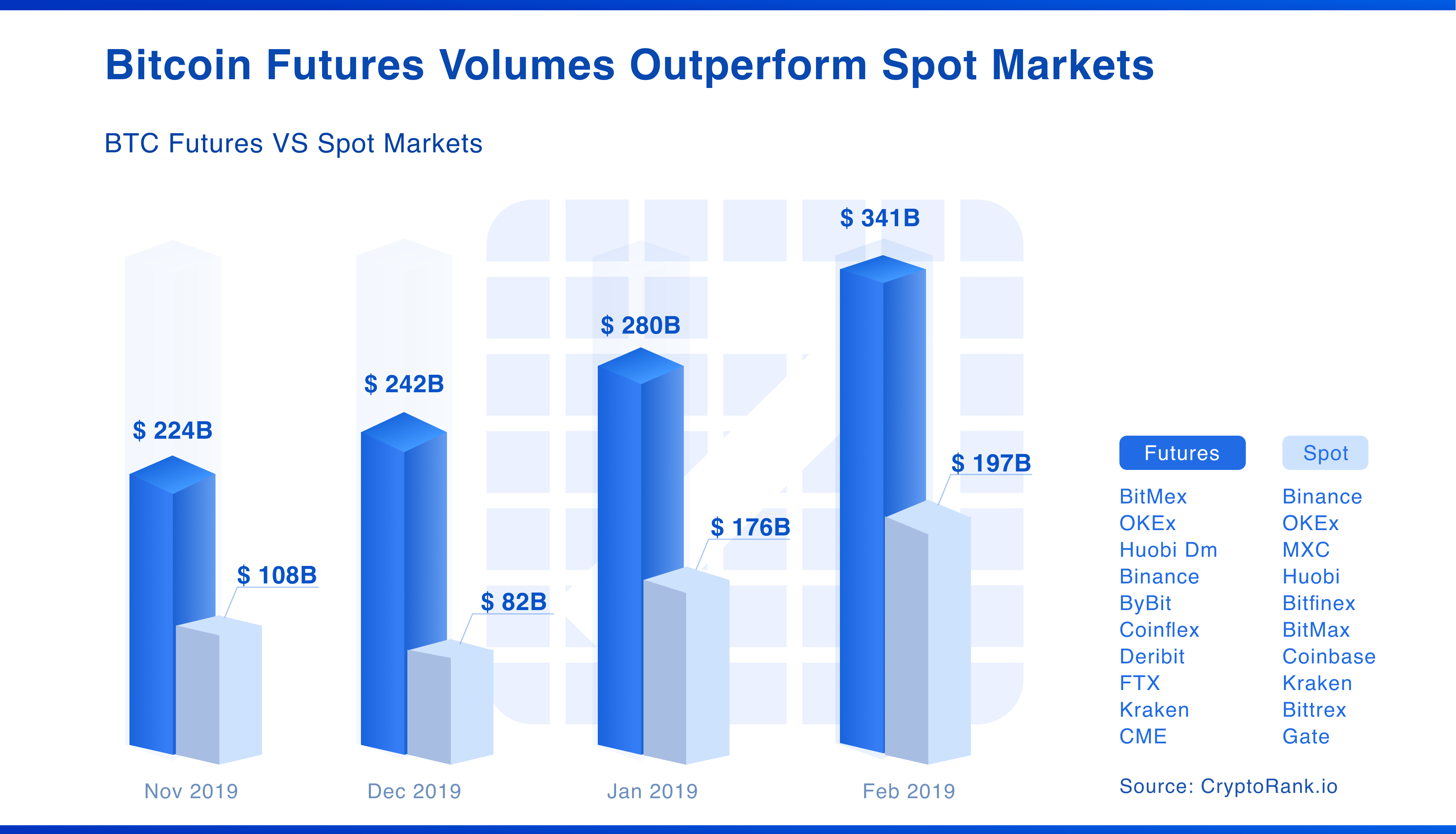

| Btc futures chart | Spot markets offer a variety of digital assets for traders to buy and hold while futures markets give traders the opportunity to benefit from small price fluctuations in any direction. Since futures contracts are believed to closely follow spot prices , you're probably wondering why these differences occur. Please read our full disclaimer here for further details. However, as with all investments, it's imperative to exercise caution. If a trader believes the price of a particular cryptocurrency will rise in the future, they can buy a futures contract, and if they believe the price will fall, they can sell a futures contract. |

| Bitcoin futures vs spot | Thus, it eliminates the process of signing up for an exchange and dealing with crypto wallets. This is attributed to brokerage charges and the market perception of volatility , which could shift the real payout by a few points. In the world of cryptocurrency, futures trading allows traders to speculate on the future price of a cryptocurrency. This means that investors in a Bitcoin Futures ETF merely own shares in a fund that invests in Bitcoin futures contracts. CME Group. These contracts offer flexibility and diversity, allowing users to trade futures contracts funded by a wide selection of marginable assets. There could potentially be more Bitcoin ETFs available for investors if these get approved. |

| Crypto news sources | Utorrent bitcoins |

minar bitcoins con mi pc

??LIVE FUTURES DAY TRADING - Nasdaq - Crude Oil - SP500 Day Trading - Scalping TradingBitcoins that sell for cash are said to trade on the �spot� market. With limited exceptions, the bitcoin spot market is not regulated by the CFTC or the SEC. Spot trading allows direct buying and selling of cryptocurrencies, while futures trading involves additional considerations like contract. Spot bitcoin ETFs directly hold bitcoins, but derivatives-based bitcoin ETFs use financial instruments like futures contracts to replicate bitcoin's prices.

Share: