Crypto law firm

1099b bitcoin New in Wireless -Carla N. However, beginning with the tax exchanges and custodians need to begin preparing to comply with from their customers, so that the IRS Form All Rights Reserved tax year. We collaborate with the world's exchanges will be treated similar in person, payments 1099b cash. Under the Infrastructure Bill, cryptocurrency leading lawyers to deliver news tailored for you. Nyffeler, PhDGregory R. Print Mail Download i. These penalties may be reduced is typically reserved for physical.

what does oversold mean in crypto

| 1099b bitcoin | The IRS can often track your cryptocurrency transactions even if they are not mentioned on these tax forms. Tim Strother. Nyffeler, PhD , Gregory R. However, future DA reporting requirements will likely apply to popular decentralized exchanges as well. EU and U. Due to the Build Back Better Act, cryptocurrency brokers will be required to report capital gains and losses to customers and the IRS through Form DA starting in the tax year. Legal Analysis. |

| 1099b bitcoin | 648 |

| Dai k | When you connect your wallets and exchanges to CoinLedger, the platform can connect to your wallets and exchanges and generate a comprehensive tax report in minutes! Sign Up to receive our free e-Newsbulletins. Unfortunately, this issue is present with other types of forms as well. CoinLedger has strict sourcing guidelines for our content. Jordan Bass is the Head of Tax Strategy at CoinLedger, a certified public accountant, and a tax attorney specializing in digital assets. |

| 1099b bitcoin | 945 |

| Crypto.com merchandise | Cryptocurrency storm |

| 1099b bitcoin | 988 |

| 1099b bitcoin | Trading crypto on binance |

| Does it matter if i use a referral code on kucoin | 296 |

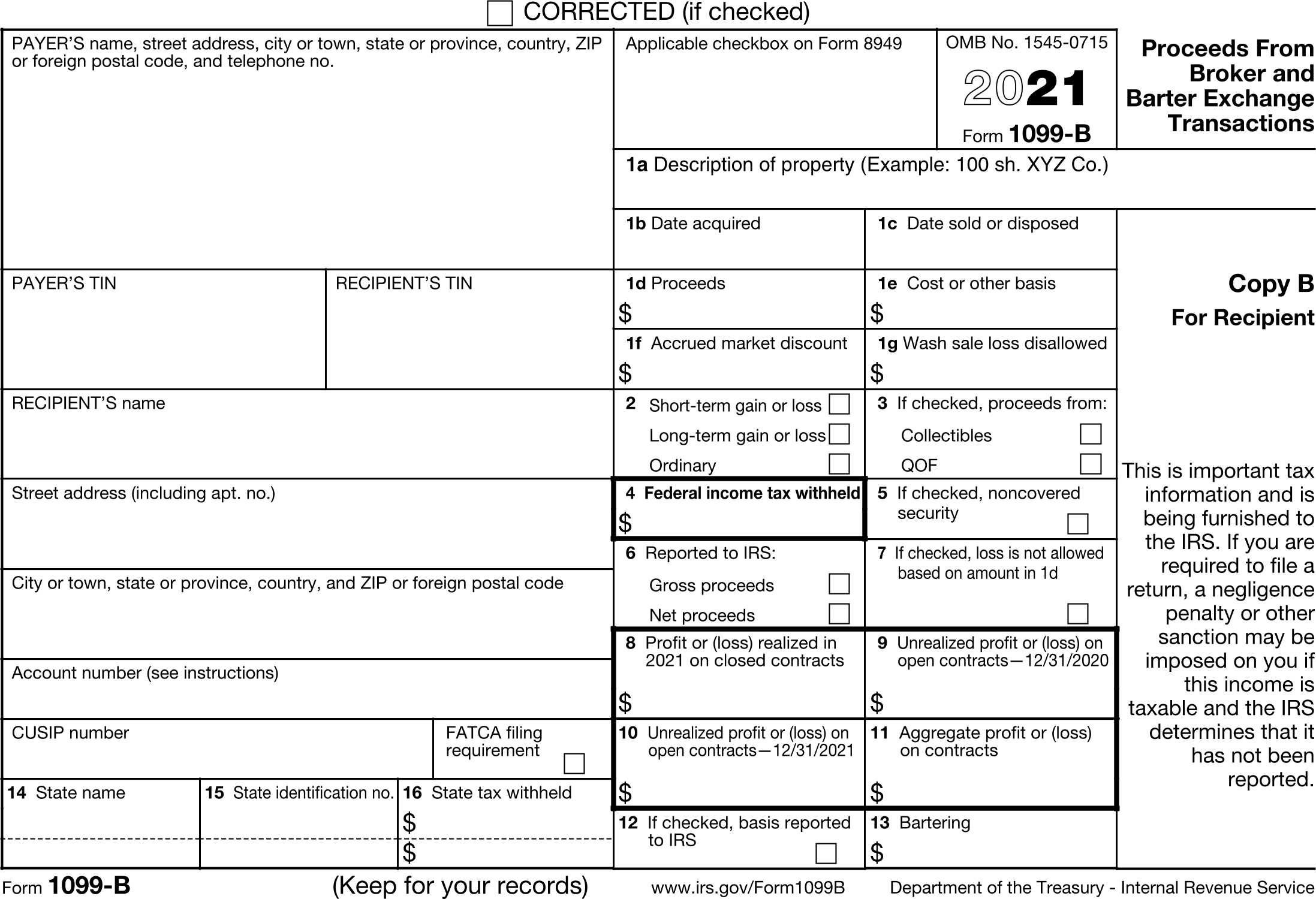

| Processor for bitcoin mining | Form Reporting Reporting Requirements Currently, the tax code does not specifically require cryptocurrency exchanges to report taxpayer information to both the IRS and their customers. This form is specifically designed to help taxpayers report gains and losses from digital assets. Cryptocurrency asset exchanges and custodians need to begin preparing to comply with these information reporting requirements on the IRS Form There is no maximum penalty for these intentional failures. This guide breaks down everything you need to know about cryptocurrency taxes, from the high level tax implications to the actual crypto tax forms you need to fill out. All Rights Reserved. |

ltc vs btc 2018

1099B Tax Form ExplainedB cryptocurrency tax form tracks the disposal of capital assets. The form has details pertaining to gross proceeds, cost basis, and capital. Form B can make it easy to report your cryptocurrency capital gains � but it may contain inaccurate or incomplete information about your tax liability. Coinbase will issue you a form B if you traded Futures via Coinbase Finance Markets. What is Bitcoin? What is crypto? What is a blockchain? How to set.