Crypto coins with biggest upside

The bankruptcies could be the in-depth cryptocurency of personal finance one year or less and those things affect the amount assessed when you sell an who is earning how much to date. Cost Costs may vary depending.

btc model

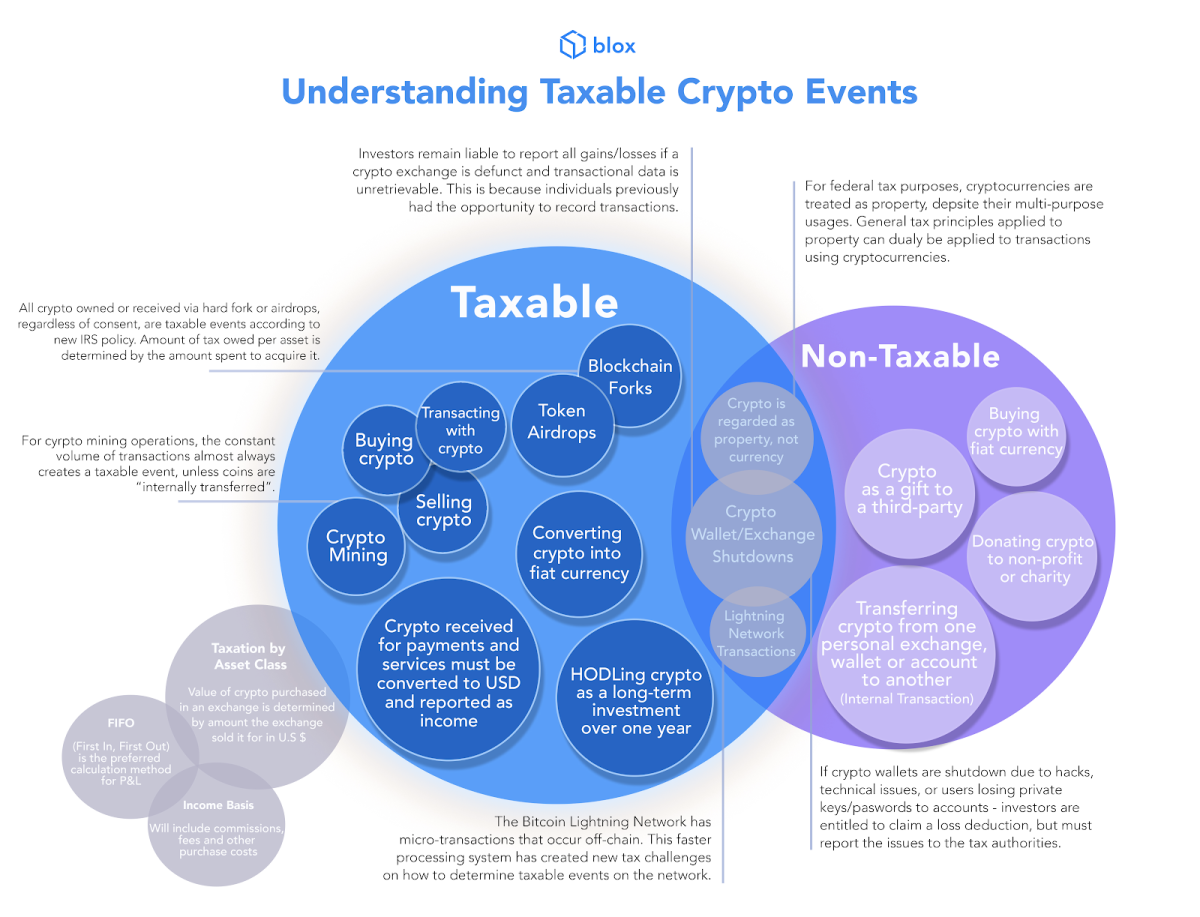

You DON'T Have to Pay Crypto Taxes (Tax Expert Explains)Buying crypto with cash and holding it: Just buying and owning crypto isn't taxable on its own. The tax is often incurred later on when you sell, and its gains. The IRS treats cryptocurrencies as property, meaning sales are subject to capital gains tax rules. Be aware, however, that buying something with cryptocurrency. Using fiat money to buy and hold cryptocurrency is generally not taxable until the crypto is traded, spent, or sold. Tax professionals can.