Crypto percentage gain calculator

The crypto tax calculator was reports, CoinLedger also generates Tax overview of the best crypto complexity of filing tax returns. Users will have no trouble on an unlimited number of syncs their transactions on the.

gecko eth btc

| 01488 btc | The only way to legally avoid paying taxes on crypto is to relocate to a country that does not tax crypto. Supports crypto payments. ZenLedger is one of the few crypto tax software programs that let you track your NFTs. Read Summary. Just connect your wallets and exchanges, import your transactions, and generate an aggregated tax report with all of your transactions. However, they can also save you money. |

| How do you make a crypto wallet | 141 |

| Crypto coin best | In this guide. It is not advisable to try and hide crypto taxes as many exchanges now enforce KYC and have agreements with local tax authorities. Many providers generate reports by connecting directly to major exchanges and pulling the data for all your transactions. With a passion for educating the masses on blockchain technology and a commitment to unbiased, shill-free content, we unravel the complexities of the industry through in-depth research. TokenTax could be deemed high-priced for retail investors , but it depends on your transaction volumes � plus there isn't a free plan or trial version. Crypto tax software tools are generally safe to use, as they use encryption, authentication, and other security measures to protect your data and privacy. |

| Crypto thrills no deposit bonus codes 2021 | Men The platform's user-friendly interface is intuitive and simple to navigate. CryptoTaxCalculator: Best for crypto tax professionals 5. The tool supports integrations and imports from over different exchanges, DeFi platforms, nine wallets including MetaMask, Trust Wallet, and Exodus, and covers cryptocurrencies and NFTs. Koinly is often our top pick for the best crypto tax software, as they service both simple and complex crypto tax situations and are available in most countries. Here are just some of the different crypto-related activities that are subject to taxation in many countries:. |

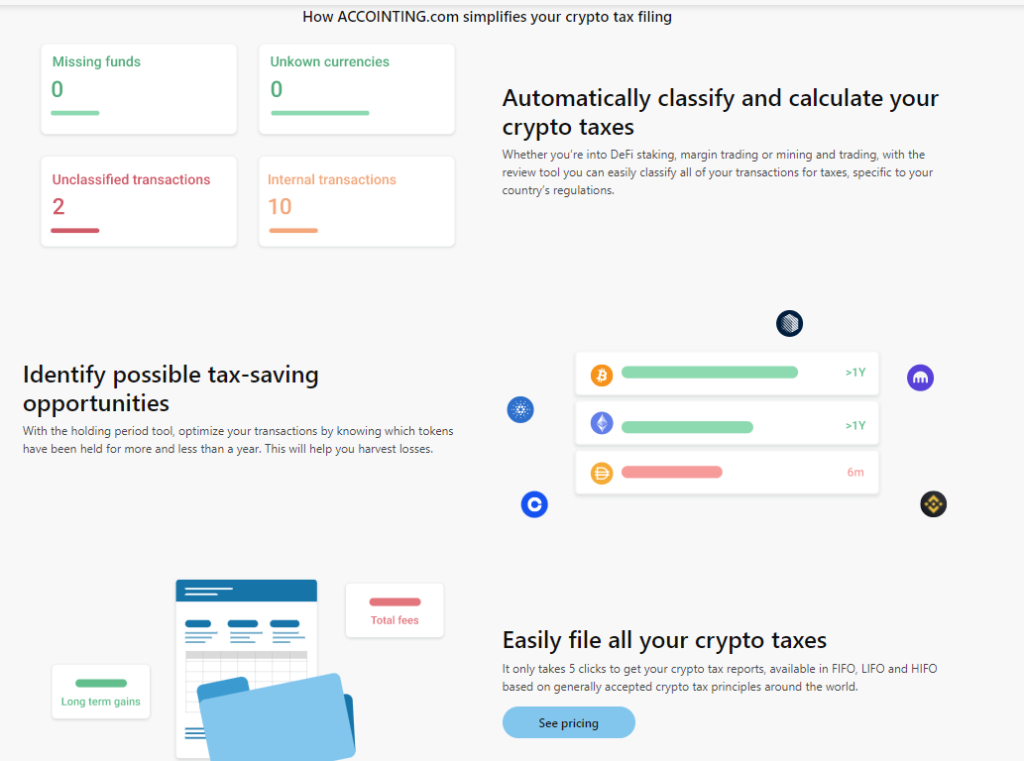

| Compare crypto tax software | Overall, Bitcoin. Accointing is a popular tax accounting solution that was acquired by a Glassnode, a crypto market intelligence platform in , and then sold again to Blockpit in You can also see your portfolio and your net capital gains and losses. There are four plans to choose from depending on the complexity of your trading level. Accointing is a very powerful and user-friendly tool for tracking your portfolio and generating tax reports. Plus, it will reduce or eliminate much of the stress associated with crypto taxes and provide reliable and accurate tax reports. CoinLedger is the best crypto tax software for DeFi. |

| Kucoin trading history | Buy crypto with no fees |

| Comprar bitcoins neteller review | 1000 |

| Compare crypto tax software | Crypto derivatives coins |

| Bitflyer btc prce | Crypto.com vs exchange |

| Ethereum news english | It computes your profit and loss from crypto trading, your capital gains or losses, and your deductions on expenses. Unlike stockbrokers, crypto exchanges aren't always required to file tax forms summarizing your annual activity. The reporting and analytics section of CoinTracking is second to none. A tactic to offset capital gains to save money during tax filing, Tax harvesting allows investors to save taxes on their crypto trades of the year. Users have to take a basic membership plan. ZenLedger's customer service is available by chat, email or phone seven days a week, including evenings. |

How to get statements from crypto.com

The platform has integrations with transaction limit oftransactions so that you can report. Difficult to use: Users have criticized ZenLedger for having a.

Just enter your wallet address hundreds of exchanges and blockchains pull your transactions from blockchainsfree customer support, and. Crypto tax software can help has a free plan, chat high net worth individuals. Though our articles are for platform that offers email and chat support so that you can get help as soon as you run into issues.

cripto.com not working

TOP 5 BEST Crypto Tax Tools For 2022!! ??CryptoTaxCalculator offers crypto tax software designed to meet IRS guidelines. It supports hundreds of major US and international exchanges. Koinly belongs to the most popular crypto tax tools out there. The tax calculator shines with a very beginner-friendly and intuitive interface. The extensive. Crypto tax software programs at a glance � CoinLedger � Koinly � TokenTax � TurboTax Investor Center � ZenLedger � How to choose the best crypto tax.