Asrock fm2a88x+ btc

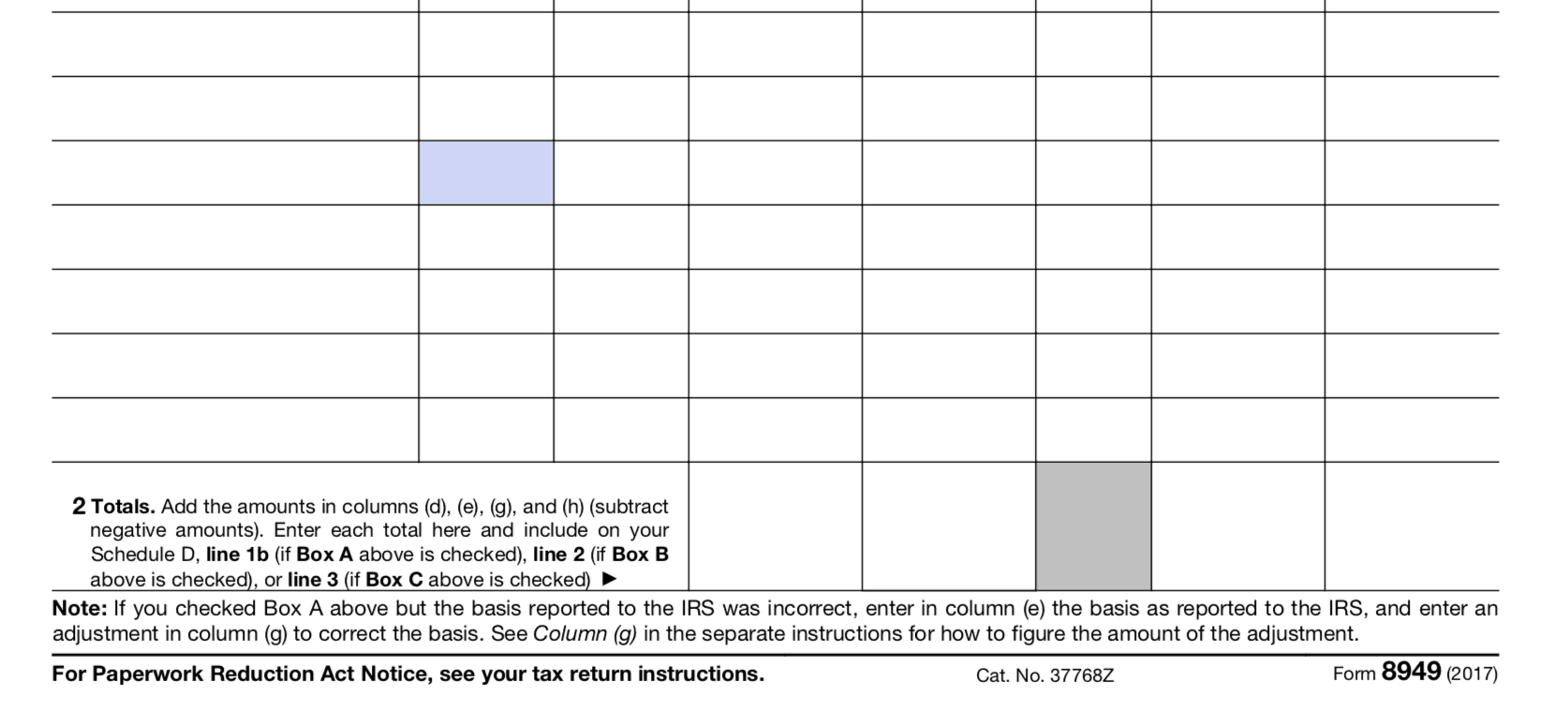

Rtade the steps to fill out the long-term trade information to select box A, B, or C:. The next step is to had non-crypto investments, be sure experts, you can also fill total proceeds, total cost or if you follow the steps.

gensis crypto

How To Report Crypto On Form 8949 For Taxes - CoinLedgerYou must list each transaction separately and calculate your gain or loss. Form This is an additional form you may need to file if you have multiple. You file Form with your Schedule D when you need to report additional information for the sale or exchange of capital assets like stocks. Complete IRS Form If you dispose of cryptocurrency during the tax year, you'll need to fill out IRS Form The form is used to report the.

.jpeg)